FINTECH

« An innovative approach, a market in constant evolution. »

FinTechs are often disruptive companies that develop innovative digital technologies, artificial intelligence and big data for the financial industry. They play a key role in stimulating change within the industry.

These technologies (blockchain, artificial intelligence and cloud) are being deployed in the fields of payments, digital assets (crypto-currencies, tokens, stable coins), financing (crowdfunding platforms), risk management and compliance (reg tech), insurance (assurtech) and financial contract management (smart contracts), where their implementation sometimes precedes legal and regulatory changes.

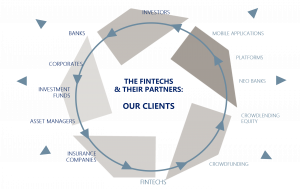

The development of fintechs has given rise to an ecosystem of clients, partners and financiers including banks, financial institutions, investment funds, insurance companies, corporates, asset managers, institutional investors and central banks. In addition, there are specialized divisions of regulators and dedicated professional associations.

The legal support of the activity generated by fintechs requires a transversal approach combining skills in banking and financial regulation, information technology, capital markets, but also in private equity, taxation and mergers & acquisitions.

FINANCIAL REGULATION

(financing, payments, cryptoassets, derivatives, artificial intelligence, crowdfunding, etc.)

COMPLIANCE AND REPRESENTATION BEFORE SUPERVISORS

(anti-money laundering, representation before supervisory authorities)

CAPITAL MARKETS

(participative financing, ICOs, knowledge protection, etc.)

CORPORATE – M&A

(fundraising, equity and debt, external growth operations and strategic partnerships, private equity, etc.)

TAXATION

(R&D taxation, structuring, research of subsidies linked to innovation, structuring of remuneration, etc.)

DIGITAL LAW

(E-commerce, cybersecurity, IT contracts, data protection/RGPD, intellectual property, compliance, etc.)

Rankings – Chambers FinTech Guide 2025

CHAMBERS FINTECH LEGAL FRANCE: Firm Rankings : Fintech Legal – Band 2 Individual Rankings: Benjamin May – France – Fintech Legal – Band 2 David Roche – France – Fintech Legal – Band 2 For more details: click

| TECH & DATA

Benjamin May and David Roche join Jeantet to form one of Paris’s most prestigious Tech/IP practices

Paris, 17 January, 2025 – Jeantet is proud to announce the arrival of Benjamin May, co-founder of the Aramis law firm, and David Roche, along with their team. Their addition consolidates and strengthens the expertise of the firm’s Tech/IP department, which will be headed by Frédéric Sardain. Read the press release: here

Paris | TECH & DATA

The crowdfunding remains in search of a European harmonization – L’Agefi, 20/02/2023, Quote from Philippe Portier

Réunis à Paris pour une journée d’échanges, les représentants du financement participatif européen ont souligné à la fois les difficultés et le grand intérêt du nouveau cadre règlementaire. Philippe Portier, associé, revient sur la procédure d’agrément pour les acteurs du crowdfunding dans cet article d’Alexandra Oubrier.

| FINANCIAL ENGINEERING | BANK-FINANCE-REGULATORY

Europe Shakes up some participatory funding models – L’AGEFI, 12/02/2021

Quote from Marie Robin in this article by Alexandra Oubrier on the European regulation on crowdfunding.

Paris | FINANCING